If you struggle with overspending and want a simple way to save money, the envelope budgeting system is a great cash-based solution. This simple, cash-based method has helped thousands of people take control of their finances and save more money. In this post, we’ll break down how it works, why it’s effective, and how you can get started today.

What Is the Envelope Budgeting System?

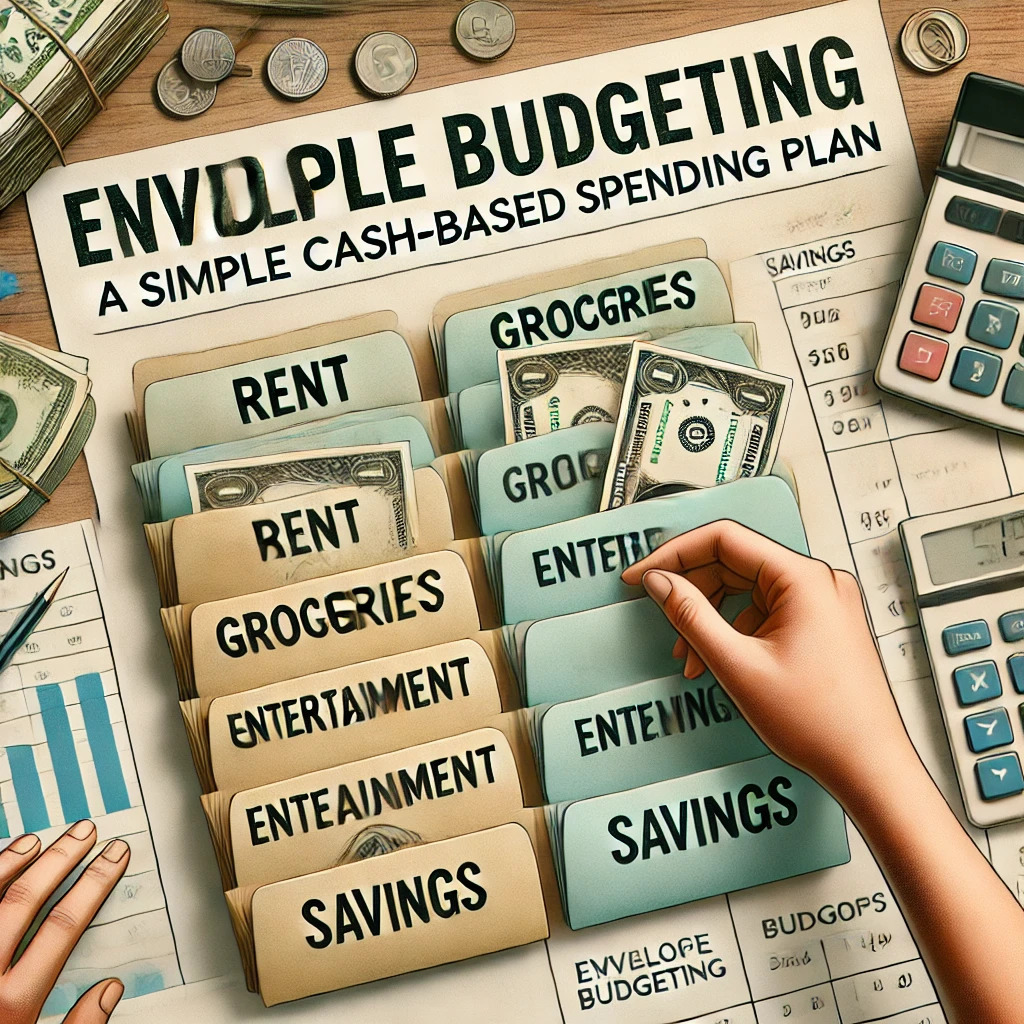

The envelope budgeting system is a straightforward way to manage your money by dividing your income into categories (like groceries, entertainment, and transportation) and allocating cash into labeled envelopes for each category. Once the cash in an envelope is gone, you’re done spending in that category for the month. This method forces you to be intentional with your spending and helps you avoid overspending or relying on credit cards.

By sticking to this method, you’ll develop better financial habits and consistently put aside cash for saving money on future expenses.

Why Is the Envelope Budgeting System Effective?

- 1 – Visual Spending Control – Physically seeing how much cash you have left in each category makes it easier to stay within budget.

- 2 – Prevents Overspending – Once an envelope is empty, you know to stop spending, reducing impulse purchases.

- 3 – Encourages Financial Discipline – The system enforces strict spending limits, helping you develop better money habits.

- 4 – Reduces Reliance on Credit Cards – Using cash minimizes the risk of accumulating credit card debt.

- 5 – Builds Savings Awareness – Leftover cash from certain categories can be reallocated to savings goals.

How to Get Started with the Envelope Budgeting System

- 1 – Determine Your Budget Categories – Identify essential spending categories such as rent, groceries, utilities, entertainment, and savings.

- 2 – Set Spending Limits – Allocate a fixed amount of cash to each category based on your monthly income.

- 3 – Label Your Envelopes – Create separate envelopes for each category and fill them with the designated amount of cash.

- 4 – Spend Only What’s in the Envelope – Use cash from the designated envelope for each expense category, and stop spending when it’s empty.

- 5 – Adjust and Improve – Evaluate your spending patterns at the end of the month and adjust your budget accordingly.

According to Investopedia, envelope budgeting is a powerful way to control spending.

Tips for Success

- Start with a few key categories before expanding.

- Keep an emergency fund separate for unexpected expenses.

- Use a digital version of the system if carrying cash isn’t convenient.

- Review and refine your budget monthly to improve accuracy.

The envelope budgeting system is a powerful yet simple way to take control of your finances. By limiting your spending to cash and categorizing your expenses, you can develop better money habits, reduce debt, and increase savings. Give it a try and see how this method can transform your financial future.

If you’re serious about saving money, envelope budgeting can be a game-changer for your financial health.