When it comes to building wealth, few concepts are as powerful—or as misunderstood—as compound interest. Often referred to as the "eighth wonder of the world" by Albert Einstein, compound interest has the ability to turn small, consistent investments into significant sums over time. But what exactly is compound interest, and why does starting early matter so much? Let’s break it down with real-life examples and show you how this financial force can work for you.

What Is Compound Interest?

Compound interest is essentially “interest on interest.” Unlike simple interest, which only earns returns on the initial amount invested (the principal), compound interest allows your earnings to grow exponentially because you earn interest not just on the principal but also on the accumulated interest from previous periods.

Here’s a basic formula to understand how it works:

A = P(1 + r/n)^(nt)

Where:

A = Final amount

P = Principal (initial investment)

r = Annual interest rate (as a decimal)

n = Number of times interest compounds per year

t = Time in years

Don’t worry if math isn’t your strong suit—we’ll use practical examples to make it crystal clear!

Real-Life Example #1 : The Magic of Starting Early

Imagine two friends, Sarah and John, who both want to save for retirement.

Here’s their story:

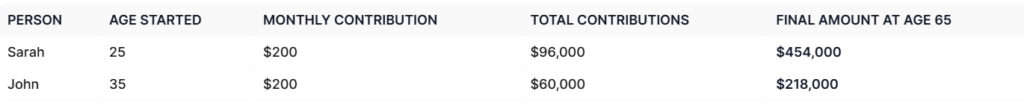

Sarah starts investing at age 25 , putting aside $200 per month into an account that earns 7% annual return compounded monthly. She continues saving until she retires at age 65. John waits until he’s 35 to start saving, contributing the same $200 per month with the same 7% return. He also saves until age 65.

Even though Sarah contributed only $36,000 more than John ($96,000 vs. $60,000), her final amount is more than double his! This happens because her money had 10 extra years to grow through the power of compounding.

Real-Life Example #1 : Small Changes Add Up

Let’s look at another scenario. Suppose Emma invests just $100 per month starting at age 22, earning an average annual return of 6%. By the time she turns 67, here’s how much she’d have:

Initial Investment: $100/month

Annual Return: 6%

Timeframe: 45 years

Final Amount: $314,000

Now imagine if Emma increased her contribution by just $50 per month ($150 total). Her final amount would soar to $471,000 —an additional $157,000 simply by adding $50/month!

Why Does Starting Early Matter So Much? Starting early gives your money more time to grow. Even small contributions made decades earlier can lead to massive differences later in life. Consider this rule of thumb:

The Rule of 72

This handy formula estimates how long it takes for your money to double based on its growth rate. Simply divide 72 by the annual interest rate. For example:

At 6% interest: 72 ÷ 6 = 12 years to double your money.

At 8% interest: 72 ÷ 8 = 9 years to double your money.

By starting early, you allow your money to go through multiple doubling cycles, significantly boosting your overall wealth.

Key Takeaways: How You Can Harness Compound Interest

Start Now : Time is your greatest ally when it comes to compound interest. Whether you’re 20 or 40, the sooner you begin, the better off you’ll be.

Be Consistent : Regular contributions, no matter how small, add up over time. Automate your savings to ensure consistency.

Choose High-Growth Investments : While savings accounts offer some compounding benefits, higher-yielding investments like stocks, mutual funds, or index funds provide greater long-term growth potential.

Reinvest Earnings : Instead of withdrawing dividends or interest payments, reinvest them back into your portfolio to maximize compounding.