Debt can feel overwhelming, but with the right plan, it’s possible to take control and eliminate it for good. In this post, we’ll explore practical, proven strategies to pay off debt faster and reduce financial stress, so you can focus on achieving financial freedom.

1. Understand Your Debt Situation

- List all your debts: balances, interest rates, and minimum payments.

- Create a debt overview to see the bigger picture.

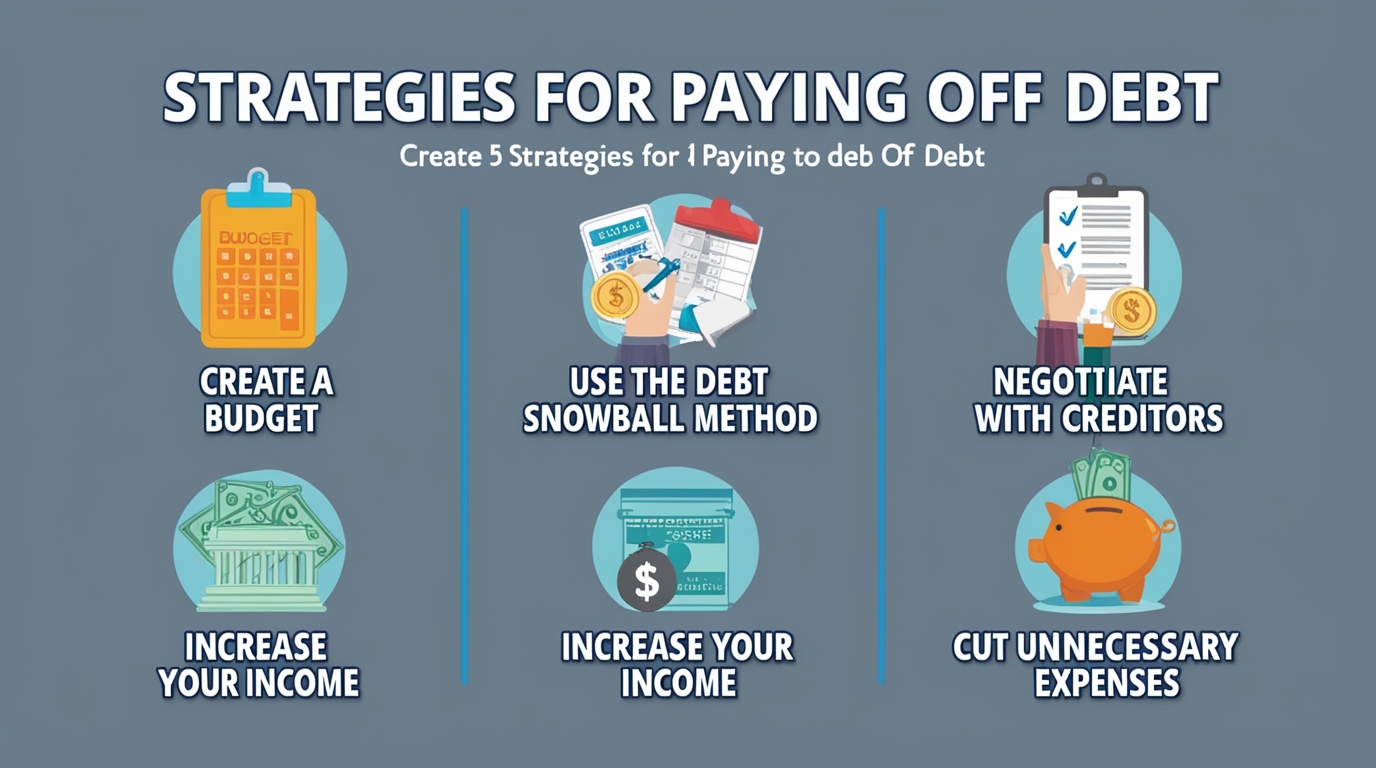

2. Choose a Debt Payoff Strategy

- Debt Snowball Method: Pay off the smallest debt first for quick wins.

- Debt Avalanche Method: Focus on high-interest debts to save money over time.

- Provide examples of each strategy with simple calculations.

3. Negotiate with Creditors

- Call your creditors to ask for lower interest rates or payment plans.

- Discuss hardship programs and balance transfer options.

4. Cut Expenses and Increase Income

- Identify unnecessary spending and redirect that money toward debt payments.

- Explore side hustles or freelance work to boost your income.

5. Stay Consistent and Motivated

- Track your progress using apps or spreadsheets.

- Celebrate small milestones to stay encouraged.

- Join online communities or forums for support and accountability.